With adulthood comes financial obligations. The transition from being in high school to going to college can be challenging. You’re in an unfamiliar environment, desperate to connect with others, bombarded with academic studies, and tasked with a laundry list of life and financial responsibilities. How do you keep from being overwhelmed?

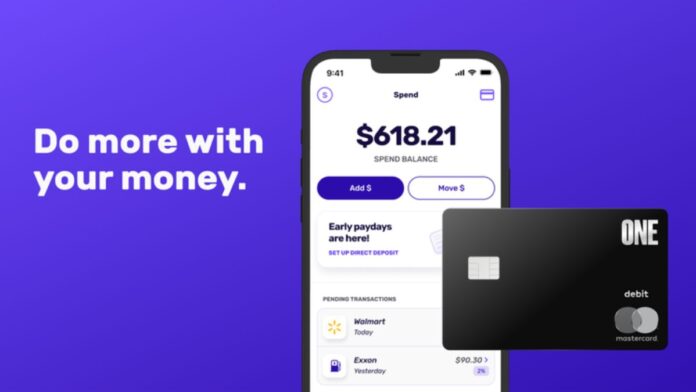

While some college students struggle academically, socially, emotionally, and financially, there are resources to help navigate the journey. Banking options like ONE are a practical solution for college students who are learning to be financially independent.

What Is ONE?

ONE is a bank that offers digital products and services to everyday consumers. If you’re wondering what a bank can do to help you throughout your college experience, it’s important to keep the following benefits in mind.

Apply, Create, And Manage Your Account Online

Not many people have time to visit a local bank, wait in line, and wait for a representative to assist them with their banking needs. When you’re a college student, time is everything. You need time to attend classes, complete homework, study, work, and socialize. So, while banking is important, it doesn’t have to be time-consuming. With the ability to apply for an account, create an online profile, and manage your banking transactions online, you can save time and energy.

ONE offers a simple application process, easy account creation, and a variety of tools to manage your money and monitor transactions. All you need is an internet connection, a computing or mobile device, and you’re ready to start banking.

Avoid Costly Banking Fees

Entry-level jobs and internships rarely pay much. In college, you don’t want to risk your earnings by putting them in a bank that’s going to charge you for everyday transactions. ATM fees and monthly maintenance charges may not seem like much, but if you were to add up your banking fees over the course of a year, you’d be surprised how much money you might be losing.

ONE stands by its zero-fee policy. Customers are never charged for maintenance, minimum balances, out-of-network ATMs, wire transfers, and other transactions. As a result, you can invest your money into other needs like bills, school supplies, food, or laundry.

Implement And Stick To Your Budget

For college kids, budgets can feel like something only adults need to do. That is until they start earning an income and acquiring bills that need to be paid. When that happens, you can quickly start to understand the significance of a budget, even if it’s hard to stick to the plan.

ONE’s Pockets are the perfect budget assistance tool to help you keep your finances intact. Pockets are sub-accounts that you can customize to match your bills and expenses. When you receive money from your job or your parents, you can schedule transfers into the appropriate Pockets to ensure you have enough money to cover each expense.

Saving For A Rainy Day

As a young adult, you’ll quickly learn how unexpectedly things occur that can throw your finances off track. Your car breaks down; you lose your job, you need to purchase something for a class, or an existing bill increases. If you don’t have the money to cover the problem, you have no choice but to ask your parents, charge it to a credit card, or apply for a loan. Each of these options could put you in debt and add to your stress.

ONE wants its customers to be prepared for those rainy days. That’s why they offer one of the highest interest rates in the nation at 1.00% APY. Simply open a Savings Pocket and deposit funds. Then, set up automatic transfers to increase your savings. At the end of the year, you’ll have ten times more money in the bank than with other financial institutions.

College is an exciting but challenging experience. Although there are various obstacles, finances don’t need to be one of them. Opening an account with ONE can help get your money under control, automatically eases your stress, and enables you to spend more of your time and energy on navigating your educational journey.

Also Read: